How Small-Cap Stocks Can Increase Your Returns When Used Correctly

Investing in a broad market index is an easy way to just follow the market and make sure you get similar returns. But what if you are anything like me, you will want to explore any option to achieve something more than that. There are tons of small-cap funds and ETFs out there, but what do they contain? Can they beat the market and should you invest in them? These are the questions I will address in this post.

What are small-cap stocks?

Small-cap is simply a reference to stocks with a market capitalization lower than some predefined value. The market capitalization is the current stock price multiplied by the number of stocks available for the company. In more general terms this is what we call the "size" of the company.

All stocks on the exchange can be divided into groups called small-, mid-, and large-cap. The broad indexes like S&P 500 mostly consist of large-cap stocks. These are the big household names we all know, like Apple, Microsoft, Walmart, Disney, Amazon, or Johnson & Johnson. As most index funds and ETFs are market capitalization weighted, this means you will be buying all the large-cap stocks - and miss out on small-cap.

Are small-cap stocks better than large-cap?

Large-cap stocks are often more established companies and may be seen as less risky than small-cap stocks. However, most of this risk can be eliminated by spreading your money across a large number of small-cap stocks through an index fund, rather than putting it all in one basket - this is a general piece of advice that goes for all kinds of investing.

Many amateur investors also prefer to invest their money in companies they know and the names that are covered in the media. This may feel less dangerous than diving into smaller stocks in companies you've probably never even heard of. But this behavioral aspect also means more money than necessary is drawn into large-cap stocks at the expense of the small-caps.

Small-cap versus large-cap performance

This topic has been researched extensively through what is now known as "the size factor". A famous study published by Eugene Fama and Kenneth French in 1992 explained stock market returns as a result of three factors:

- The market beta factor: The returns given by simply being in the market

- The value factor: The excess returns found in value stocks compared to expensive stocks

- The size factor: The excess returns found in smaller stocks versus large stocks

Fama was later given the Nobel Prize in economics and the model was expanded in multiple ways, but this is all outside the scope of this blog post. What we want to look into is the last part, the size factor.

Historical performance of small-cap stocks

Andrew Berkin and Larry Swedroe have elaborated further on the research in their brilliant book Your Complete Guide To Factor-Based Investing (which I by the way highly recommend to anyone interested in excess stock market returns!).

They found that from 1927 to 2015 the smallest 50% of all US stocks outperformed the largest half by 3.3% annually on average. Now, this is something! Assuming the largest half is roughly similar to the general market performance, I have compared an initial investment of $1,000 in small-caps vs. large-caps in 1927:

| Investment | Value in 1927 | Annual return | Value in 2015 |

|---|---|---|---|

| Small-cap | $1,000 | 11.6% | $15,650,000 |

| Large-cap (market) | $1,000 | 8.3% | $1,115,000 |

The difference over such a long period (88 years to be exact) is indeed spectacular. But before you throw your entire portfolio into small-cap stocks, there are a few caveats and things you should know.

Are small-cap stocks more risky?

High returns often go hand in hand with high risk. And as you might have expected, investing in small-cap stocks does involve higher risk and volatility than just following the broader market. This also means the consistency in the outperformance of small-cap stocks has varied greatly through history. The average outperformance of 3.3% hides plenty of negative years and long periods of underperformance.

Are small-cap stocks a good investment today?

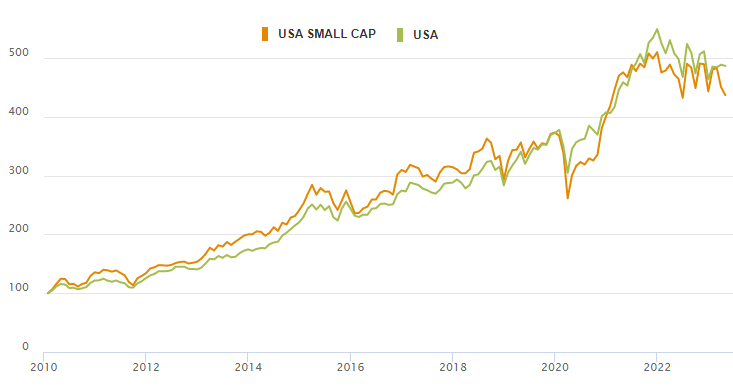

Just look at the chart below. Using data from MSCI I have compared US small-cap stocks with the overall US stock market over various time periods. What's probably most alarming is the finding that small-caps haven't outperformed the broader market over the last 13 years starting from 2010:

The big question is: Did the outperformance of small-cap stocks just stop, or is it simply a bad period stretching over many years? Data from Berkin and Swedroe suggest the latter is the case. They found that holding small-cap stocks over any given period of 10 years gives a 77% chance of outperforming the market. For a 20-year holding period the number is 86%.

This could mean the current underperformance is just a natural part of small-cap investing, as it has happened previously from time to time. But for most people, 20 years is a very long time to wait for something that still has a 14% risk of underperforming the market. For comparison, there's only a 4% chance of not making money from a 20-year investment in the general market, according to data from Berkin and Swedroe's book.

Looking just a bit further back in history, I found that small-cap stocks also underperformed the general market over the 17 years from 1983 to 2000. This came after 8 years of substantial outperformance, however. But again it shows that the returns can be highly unpredictable.

How to improve returns with small-cap stocks

In my search for a viable strategy to improve returns with small-cap stocks, I finally stumbled on the so-called Small-Cap Value premium. This has been researched and described since the initial Fama/French study and further quantified by Jemery Siegel and Berkin/Swedroe among many others.

Basically, numbers show that small-cap stocks perform substantially better when a value filter is applied. This means, instead of just buying all stocks with a market capital below some predefined value, this list of stocks is filtered to only buy the small-cap stocks that exhibit certain value characteristics such as low price/earnings or low price/book values.

Berkin and Swedroe found that small-cap growth stocks (the expensive stocks, and the opposite of value) actually underperformed the general market historically, and by removing this part from the puzzle, the returns will of course be higher. Jeremy Siegel found that in general the smaller the market cap, and the cheaper the stock (value), the higher returns can be expected.

Historical performance of small-cap value stocks

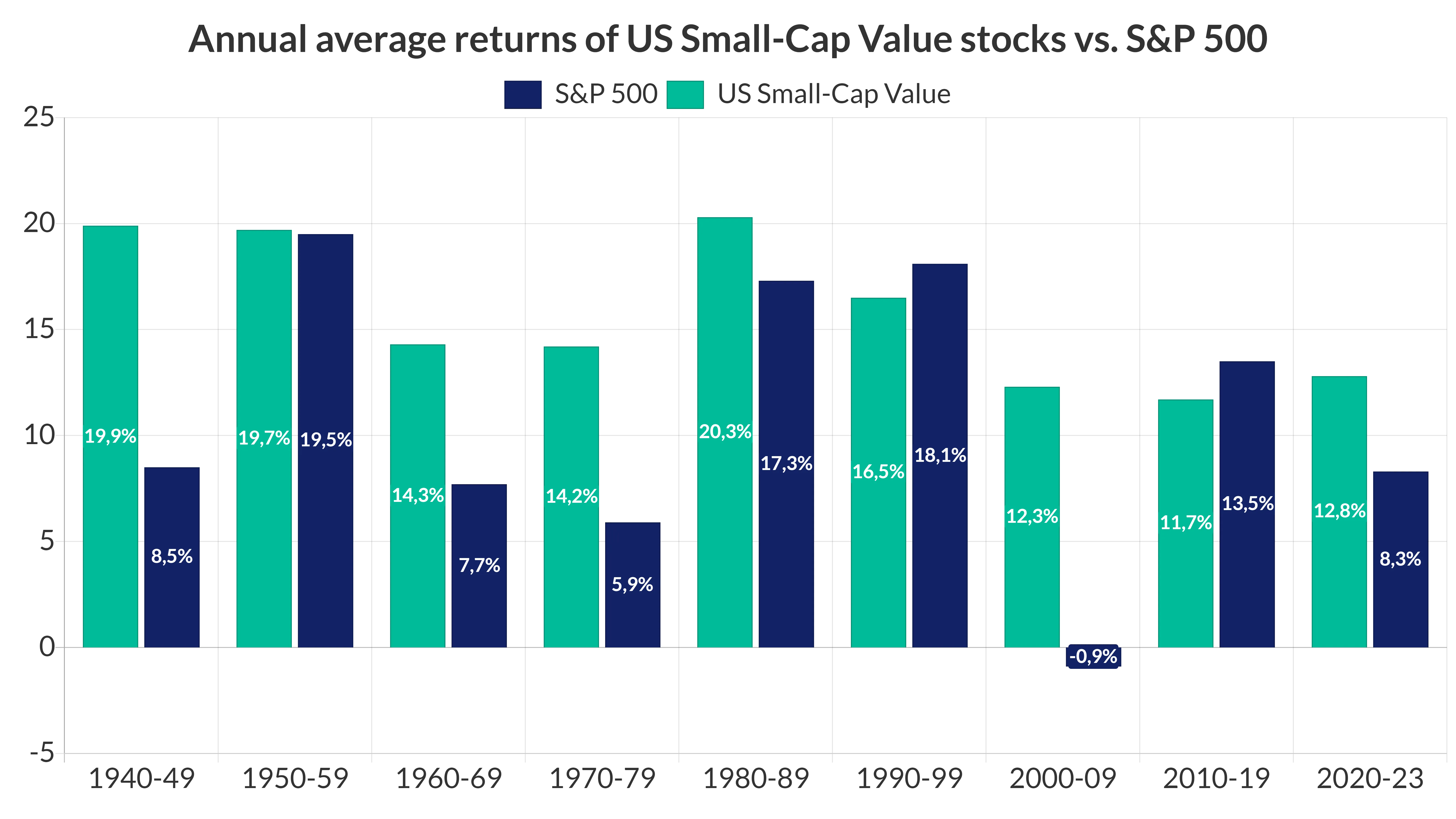

As you might expect, the small-cap value premium has been highly unpredictable from one year to another and often negative. But what's more interesting to a long-term investor like me, is whether the outperformance of an investment in small-cap value stocks has been persistent over time, as measured in decades. So I took the time to aggregate return data back from 1940 and grouped them by decade in the bar chart below.

As you can see, there are full decades where even small-cap value stocks can't beat the S&P 500. But notice how relatively insignificant the underperformance is in these cases - and compare this to the extent by which they beat the market in the "good" decades. And surprisingly it also seems like the returns of small-cap stocks are more stable from decade to decade compared to the S&P 500 returns, which seems to be more unpredictable.

Be aware that the last bars only represent the first three years of the 2020s, so we don't know yet if this will be another decade of outperformance for small-cap value stocks. But I really like the fact that when they beat the market, they do it by much larger percentages, than when they underperform. Based on current evaluations some analysts believe that small-cap value stocks are set up for a great run in the coming years.

Conclusions

Small-cap stocks have historically outperformed the general stock market when looking at annual average returns over the long term. But this hides long periods of underperformance, which means an investment in small-cap stocks can be a very unpredictable ride. Filtering small-cap stocks on value and removing the growth stocks from the small-cap universe has implied even higher historical returns. Not only have returns been higher, but apparently also more stable from decade to decade compared to investing in a general S&P 500 fund.

If your time horizon is long enough (10+ years) there seems to be a great chance that small-cap value stocks will be a good investment. Personally, I have a great part of my pension funds allocated into a small-cap value ETF for the reasons described in this post.