Can You Beat the Market? Here's How to Increase Your Chances of Success

I was good at school. I have strong mathematical and analytical skills. I get high scores in IQ tests. Yet, for many years I was really bad at stock investing. Why? Because I just assumed I would be good at it without understanding what it takes. Continue reading, if you want to learn from my mistakes.

Am I smarter than most people?

Most people will answer yes to this question. Research shows that approximately 75% of all people believe they have above-average intelligence. The pattern is strongest among men, which intensifies the effects on the stock market, where women still seem to be a minority.

When I was younger I had this inherent belief that I could succeed in everything, so why not give the stock market a go? I quickly found patterns in price charts and learned about technical analysis, trend-following, and break-out patterns. Did I make money? Nope. I lagged the market by a wide margin even though I thought I knew exactly what I was doing.

So, why did it not work out for me?

The Dunning-Kruger Effect

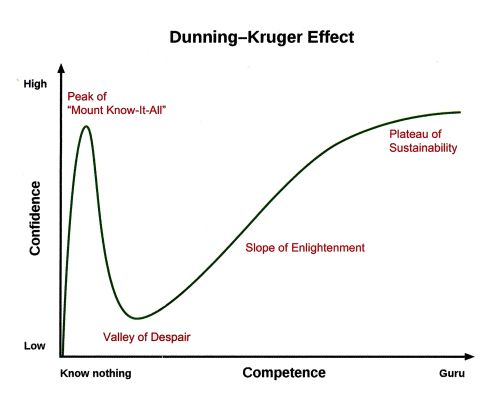

In 1999 two professors in psychology published a research paper and gave name to the Dunning-Kruger effect. Simply put, it explains how people with the least competence in a field tend to overestimate their knowledge and be way too confident.

As you gradually learn more about a subject, you also realize how much you don't know, and how complex it can be. That's why more experienced people sometimes have less confidence than people who are new to a subject.

Overestimating one's own abilities can be dangerous when there's money on the table, such as on the stock market.

The big boys of Wall Street

When we're active on the stock market, we always need to remember that it's a huge game and that we are up against professionals from Wall Street and other financial centers around the globe, who have been analyzing the stock market full-time for decades.

Do we really believe we have a realistic chance of beating these guys?

A small tip to always remember when you're buying or selling a stock at a given price: There's always someone at the other end doing the opposite trade, and thus having the opposite belief. Who is right? Only time will tell.

How good are the professionals?

It has been said that the stock market is one of the few places, where inexperienced people can actually beat the most experienced. How is that possible?

As you may know, research shows that even experts and professional traders rarely beat the market over time. They may have good years, where everyone starts following their advice - only to be followed by mediocre performance in the long run compared to market indices.

Passive index investing

You probably heard it before: Just put your money in index funds, and you will easily beat 95% of all the active traders out there. Too good to be true? It's not. But in order to gain the benefits, you need to stay calm and disciplined, and this is where most people lose it.

Even during the darkest hours, during market crashes, and when everything only seems to go further down, you need to sit on your hands and stick with this strategy.

When your friends, neighbors, and co-workers brag about their returns from individual stocks and give you tips: Don't do it. Stick to your index funds.

When you're fascinated about the future prospects of a company and feel sure it will be a success: Don't buy the stock. Stick to your index funds.

Few have the discipline to follow this strictly, and that's why most people end up losing money in the market.

The role of the media

Another common misconception, especially among retail investors, is the need to constantly stay updated on world news, and financial and geopolitical news in the media. 99% of the time this brings nothing good, but drives you to sell when you shouldn't sell. Always remember the media has a completely different motivation, which is to catch your attention. I recently wrote another post about the impact of the media on our investing behavior.

Is it possible to beat the market?

Okay, so most people can't beat the indexes. Even the vast majority of experts and professionals lag the indexes in terms of performance. Most people find it difficult to even just buy index funds and stick to the strategy when it hurts.

Is it really possible to beat the markets in the long run, then?

I believe it is, and there's a small minority of people who have proved it. How?

Find a systematic strategy

Basic human instincts like fear and greed are programmed to destroy our financial success. The only way to get out of this is to eliminate human emotions and strictly follow a systematic approach.

Index investing is an example of a systematic approach, where gut-feeling and emotions are not involved in the stock selection. A simple algorithm, typically based on market capitalization (company size), decides the stocks to invest in, and the position sizing, so we don't have to make any decisions.

I'll get back to the systematic strategies in a moment...

Beyond index investing

First I want to make it clear, that in order to beat the market, you have to move past the general market index funds. This means, either move into stock picking or invest in more specialized ETFs. By specialized I mean one of the following:

- Factor-based ETFs (small-cap, value, etc.)

- Sector-based ETFs (technology, health care, etc.)

- Theme-based ETFs (robot technology, solar energy, etc.)

In order to be systematic, you need to either simply buy and hold (if you believe an EFT will outperform the market in the long run), or you need to know exactly when and under which circumstances you will buy or sell. Emotions and gut-feeling needs to be completely left out.

Here are some examples of ETF-based strategies that have all beaten the market historically:

Systematic stock-picking

If you're willing to take on a bit more risk and you want to optimize your chances of beating the market, you should create a systematic approach for picking stocks. I'm planning to do a post on this in the near future, but there are certain common characteristics of stocks that raise the odds of future outperformance. Countless systematic strategies can be built on the foundation of this. It's all about learning what consistently works in the market and improving your probability of success by utilizing these learnings in a systematic manner.