Here's Why Warren Buffett is No Longer Beating the Market (2023)

Warren Buffett is known as the greatest investor of all time. What I will reveal in this post is a surprising fact, that few people seem to notice: His performance is almost entirely based on abnormal returns in the first few decades of his career. Warren Buffett has not been able to beat the market for many years.

Everybody wants to do what Warren Buffett does

When Warren Buffet speaks, people listen. There is no end to the amount of Warren Buffett quotes floating around on the internet and at any place where investing is in focus. And for good reason:

Since 1965 the man has achieved an annual average return of 19.8% through his company Berkshire Hathaway. This is double the annualized return of the S&P 500 index at 9.9%. Doubling the index return in a single year is not impossible, but doing so on average over a period of almost 60 years is nothing short of outstanding. However, as well will see shortly, this is no longer the case.

The richest man on the planet

For many years he was the richest man in the world, because of his investing merits. Today he is still the fifth richest person on earth and by far the richest person among those who created their fortune primarily based on investing.

1,000 dollars invested in the S&P 500 index in 1965 (with dividends reinvested) would have resulted in $249,000 in 2023. If you had instead put your money in Berkshire Hathaway stocks managed by Warren Buffett, your 1,000 dollars would have turned into roughly $38,000,000.

| Investment | Value in 1965 | Annual return | Value in 2023 |

|---|---|---|---|

| BRK-A | $1,000 | 19.8% | $38,000,000 |

| S&P 500 | $1,000 | 9.9% | $249,000 |

Breaking down returns by year and decade

The numbers I just presented are absolutely mind-blowing, and they represent the wonders of compounding. Numbers don't lie, but the devil is in the detail. While everyone seems to focus on his total history of returns, I decided to dig a bit deeper to understand when his outperformance happened.

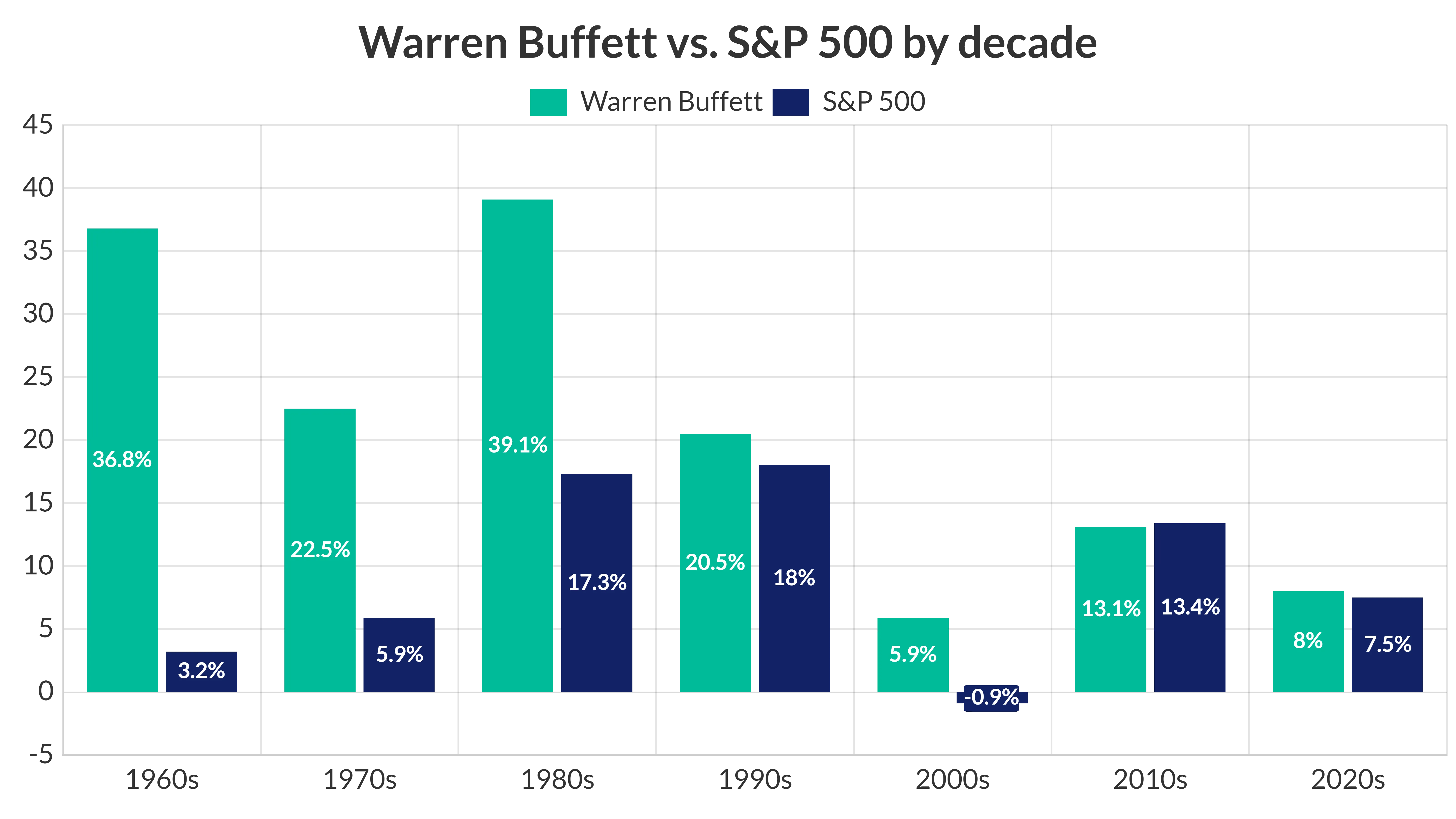

The chart below is a breakdown of his average annual returns by decade compared to the general stock market using the S&P 500 index as the benchmark. If you can outperform the S&P 500 index on average over a 10 year period, you can rightfully say that you are beating the market.

The first thing to notice is the unbelievable track record he held through the 1960s, '70s, and 80s. Let's not take anything away from this man. These are the numbers that put him in the books as the greatest investor of all time.

Is Buffett no longer beating the market?

Regardless of the amazing returns created through the first half of his career, the chart also reveals his inability to consistently beat the market in the second half.

Let's do the same small comparison with the S&P 500 again, but this time only looking at the last 25 years, investing $1,000 in Berkshire Hathaway:

| Investment | Value in 1998 | Annual return | Value in 2023 |

|---|---|---|---|

| BRK-A | $1,000 | 7.4% | $5,985 |

| S&P 500 | $1,000 | 7.0% | $5,350 |

This tells a completely different story. An annual return of 7.4% versus the 7.0% of the market is not a significant outperformance. Investors who have blindly followed Warren Buffet for the last 25 years have not gained a significant advantage over just buying an S&P 500 index fund.

But how do these numbers correlate with the overall picture and the astonishing total returns created since 1965? To get the complete picture, let's look into the remaining period of his career and his returns up until 1998:

| Investment | Value in 1965 | Annual return | Value in 1998 |

|---|---|---|---|

| BRK-A | $1,000 | 30.5% | $6,525,000 |

| S&P 500 | $1,000 | 11.7% | $39,000 |

It is obvious now that the greater part of his fortune was created in the past century, when he was able to beat the market by a wide margin. Over the past 25 years, he has delivered returns that were more or less on par with the market.

How did he lose his ability to beat the market?

There are two main reasons for this:

1. The increasing size of Berkshire Hathaway

Because of his success, Berkshire Hathaway grew into one of the largest companies in the world. In the early years, he was able to buy small companies that no one else noticed. But the growing amount of money to invest puts a lot of limitations on his options - it doesn't make sense to buy small companies anymore, and it has become a lot harder for him to buy companies without pushing up the price, simply because of the amount of money that's being put in the table.

2. Investment factors getting known by the public

The driving factors behind his early outperformance were value, quality, and to some extent size. Buffett knew that these factors were driving forces behind above-average returns long before academics started investigating these phenomena in the 1990s. Today everyone can buy an ETF that filters stocks based on any or all of these factors and get returns that are somewhat similar to Berkshire Hathaway.

Is Warren Buffett still worth following?

There is still a lot of attention on Warren Buffett in the investment world today, as most people still see him as a prophet in his field. Investing in Berkshire Hathaway with the goal of beating the market does not make much sense anymore. Neither does following his buying and selling of stocks, even though it creates major headlines in the media every time.

But his speeches, books, quotes, and annual letters to investors still hold a lot of valuable information that is worth paying attention to for most investors, even today.

Conclusions

Warren Buffett established himself as the greatest investor of all time through achievements in the past century. What most investors today don't seem to notice is that he is no longer significantly beating the market, and he has not been able to do so for the last 25 years.