This is the Best Long-Term Investment Vehicle (2023)

Investing for the long term requires a basic understanding of the historical returns of various asset classes and investment opportunities. There's no way to predict future returns, but looking at the history (and consistency across periods) is the best tool we have. In this post, I will make a comparison of the long-term average returns of the most popular investment vehicles.

Cash

Keeping savings in cash might be seen as "not investing", but nevertheless it's an option, and it's the default choice for a lot of people, who haven't had the chance to investigate other long-term investment vehicles.

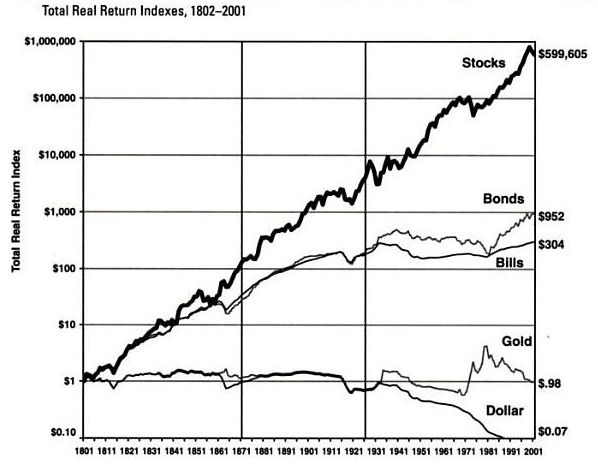

Since cash doesn't generate any value, it's only affected by inflation, which slowly decreases its purchasing power. Since 1802 the average annual return of cash has been -1.4%.

Gold

From time to time through history gold has been a popular long-term investment - especially as a diversification ingredient in a portfolio and as a safe haven investment to flatten out the drawdowns when going through rocky times in the economy.

It certainly has a diversification effect, as it tends to rise when stocks go down and investors flock into alternative allocations of their capital. The theoretical benefit of the precious metal is that the total amount of gold in the world is somewhat steady - and the price is therefore mostly driven by changes in demand.

But the long-term average returns of investing in gold might seem disappointing if you don't already know. The average annual return since 1802 has been a mere 0.7% when adjusting for inflation.

Bonds

A classic 60/40 portfolio consists of 60% stocks and 40% bonds. Most pension setups and 401(k) plans consist of a mix of the two, where bonds constitute the safer and less volatile component, but in general also a lower return than stocks.

Bonds is actually a rather broad term and covers a total world market value estimated at around $120 trillion. The return usually correlates with the expected risk - for instance, Swiss government bonds give a significantly lower return than those issued by the likes of Venezuela or Zimbabwe. Simply because the risk of a debt default (and thereby a loss of the invested capital) is significantly lower in a country like Switzerland, than in young and rocky economies like Venezuela or Zimbabwe. Bonds have in average returned 3.6% annually between 1802 and 2012.

Real estate

It's not uncommon that a piece of real estate becomes the greatest investment of your life as a private investor - simply because it's the asset you pour the largest amount of money into. Even though we don't always see it as an investment, it may result in life-changing gains, as the price of real estate has only gone one way in a historical perspective. The fact that private investments in real estate are often geared just accelerates the size of the returns.

Aside from buying actual properties, an easier way to gain exposure to real estate as an investor is through REITs (Real Estate Investment Trusts). REITs can be compared to mutual funds for stocks, but only for real estate. The average annual return of real estate has been around 4.0% adjusted for inflation.

Stocks

The combined value of the world stock market totaled $105 trillion in 2022. Together with bonds, stocks represent the most common and accessible investment options.

Although the history of the stock market is filled with breathtaking ups and downs, the long-term trend has been remarkably steady. This is - at least in part - because we as a civilization have continuously developed and improved. The free market forces have resulted in companies contributing to continuous economic growth, and being an owner of stocks, you are an owner of companies, and thereby you deserve to take part in the growing earnings.

Over the 210 year period spanning from 1802 to 2012, stocks have on average delivered an annual inflation-adjusted return of 6.6%. One might say that stocks are the best long-term investment vehicle, but let's continue for a moment.

Cryptocurrencies

From a historical perspective, cryptocurrencies still represent a very new and immature form of investment. There's no doubt that returns have been extreme since the introduction of Bitcoin in 2009 but so has the volatility and the violent drawdowns.

Making a historical comparison of Bitcoin vs. the classic asset classes is not straightforward and probably not fair - mostly because we have no way of knowing if the gains of the past 10 to 15 years can continue going forward.

Over the last 10 years spanning from 2013 to 2023, Bitcoin has delivered an average annual return of a whopping 104%!

Stocks for the long-term

Now that we have some numbers representing the historical returns of the most common investing assets, let's make a comparison and draw some conclusions:

| Investment | Annual return | Result of $1,000 invested over 30 years |

|---|---|---|

| Cash | -1.4% | $655 |

| Gold | 0.7% | $1,233 |

| Bonds | 3.6% | $2,889 |

| Real estate | 4.0% | $3,243 |

| Stocks | 6.6% | $6,803 |

| Bitcoin | 104% | * |

As Bitcoin hasn't been around for anywhere near 30 years yet, we can't rely on any expected result over this timeframe. But it's clear from this comparison that stocks have outperformed all of the other asset classes over the long run if invested in a market-wide index.

So if your time horizon is long enough and you can stomach the ups and downs that evidently occur on the stock market, you may very well be making a fortune in years to come. It's safe to say, that the best long-term investment vehicle in our historical analysis is the stock market.

What about diversification?

As a final note in this analysis, I want to add a few words about diversification. It is widely acknowledged that "diversification is the only free lunch in investing". Basically, this means that by spreading your capital across various investments and asset types, your portfolio will most likely be exposed to less volatility (which to some might be perceived as less risk).

One should however not forget that this lower volatility is only a gift in the short term. But in the long run, it will most likely drag down the total investment returns. The numbers above clearly show that a 100% stock-allocated portfolio would have outperformed a more diversified portfolio consisting of a mix of asset classes. But as always there are no guarantees that historical returns are representative of the future.

That being said, our conclusion is clear: Stocks are the best long-term investment if you want a high probability of high returns and if you believe that more than 200 years of stock market history has not come to an end.