Why Dividend Investing Can Be a Bad Strategy and Not Deliver What You Think

Dividend investing has become an increasingly popular investment strategy. A steady flow of recurring cash being paid out to your account seems like an attractive setup, but is this really a good investment strategy? I have done the research. Let's get to it.

The most common misconception about dividend stocks

A very common misunderstanding when people decide to invest in dividend stocks is the perception of free money. The profit from owning stocks comes from two sources:

- Price gains

- Dividends

The historical average price gain on stocks has been around 8% annually. But dividends don't come as a free add-on on top of the price gain, but rather at the expense of price gains. This is a super important point to understand. Let's take an example:

Let's pretend the Amazon stock has gained 8% from $100 to $108 since last year. If the company decides to pay out a dividend of $3 per stock, the stock price will (all else being equal) go down by the corresponding amount from $108 to $105.

In other words, the dividend can be seen as a forced withdrawal of a predefined amount of money from your stocks. That's why you will most often see the price of a stock go down on the day the dividend is withdrawn.

The problems with dividend investing

Now, you might say that a dividend of $3 and a price gain of $5 amounts to the same as simply getting $8 in price gains. In theory yes, but there are a couple of issues under the surface.

Reinvesting or losing out on compounding

Let's say you own 1,000 Amazon stocks. Having a $3 dividend per stock means you will have $3,000 (or what is left after taxes) paid out to your account. Now you need to decide if you want to reinvest the money.

If you don't reinvest the dividends, you will miss out on the compounding effect. The dividend payout will stop increasing in value, while only the remaining 5% gain will add to the compounded value of your investment.

On the other hand, if you decide to reinvest the money, you will most likely be charged a fee depending on your broker - which wouldn't have been the case if the company hadn't paid the dividend in the first place.

The tax issue

Another issue with dividends is taxes. In most countries, you will be taxed immediately on the dividends, while price gains are not taxed until you decide to sell the stock. In the latter case, it means you can postpone the taxes and thereby increase the compounding effect.

There may be situations depending on your financial situation or the tax rules of your country that affect this. But in most cases, you will want to postpone taxes as much as possible to keep adding to your snowball. This is simply not possible with dividends being paid out on a recurring basis.

Historical performance of dividend stocks

So, why are dividend stocks so popular? Is it because they beat the market and outperform other stocks?

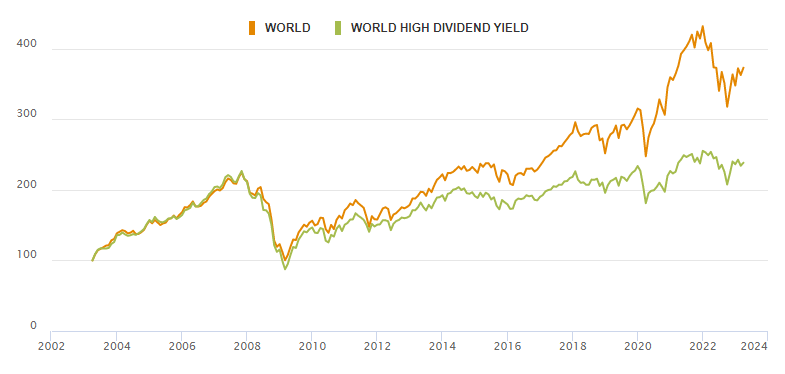

I made a comparison between the MSCI World Index (the primary representation of the entire stock market) and the MSCI World High Dividend Yield Index. The latter consists of stocks from the same universe as the first one but filtered to only include stocks with a high dividend yield.

It may be surprising to see that the dividend stocks actually performed worse than the overall world index. All dividends are reinvested along the way. In other words, the underperformance can't be explained by not having total returns included. The detailed numbers and average annual returns are calculated for you here:

| MSCI Index | Annual return | Result of $1,000 invested over 20 years |

|---|---|---|

| World | 6.8% | $3,729 |

| World High Dividend Yield | 4.4% | $2,383 |

So, we can conclude that buying stocks only because of a high dividend yield is a bad strategy compared to simply owning a global stock fund or ETF.

Can the Dividend Aristocrats beat the market?

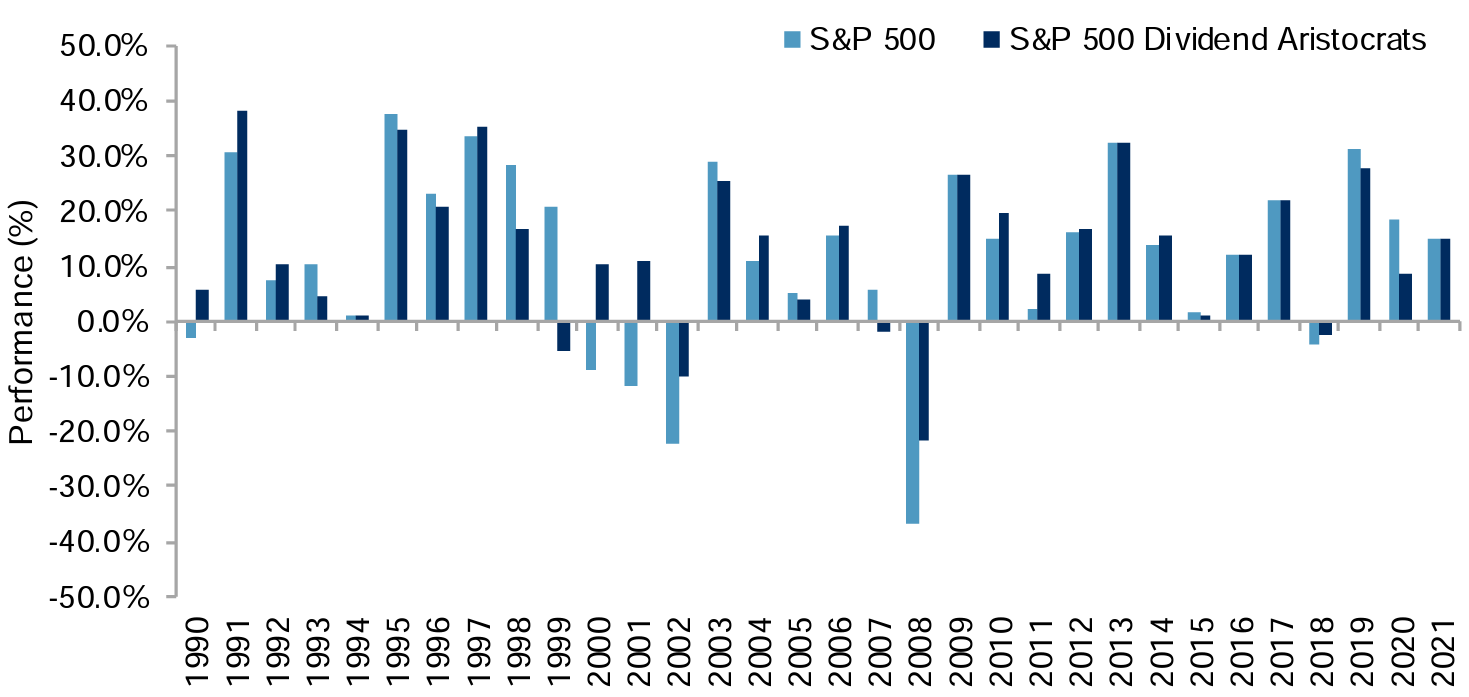

Another popular dividend strategy is to invest in the so-called "Dividend Aristocrats" index. This is a selection of stocks that have increased dividends for at least 25 consecutive years. Following this dividend policy is a good sign of quality and stability for a company and many investors like these traits.

The obvious question is of course: Have the Dividend Aristocrats been able to outperform the market? S&P Global published a great article on this in 2021, from which I borrowed the annual return chart below.

The performance vs. the S&P 500 index varies greatly from one year to another, but a few quick conclusions can be made:

- The Dividend Aristocrats underperformed the S&P 500 in the 90's

- It outperformed the S&P 500 in the 00's

- Then it underperformed again throughout the 10's

- The drawdowns of the S&P 500 went much lower than for the Dividend Aristocrats

According to various sources, the historical long-term performance of the Dividend Aristocrats is approximately 1% higher than that of the S&P 500 index. But as the data above reveals, it might take a very long time horizon to eventually see this outperformance. Furthermore, these numbers represent gross returns. This means all the expenses of reinvesting dividends and paying tax upfront are not included.

Dogs of the Dow

For the complete picture, let's also take a look at another popular strategy called "The Dogs of the Dow". Following this strategy, you reset your entire portfolio once a year and simply buy the 10 stocks from the Dow Jones Industrial index that provided the highest dividend yield in the previous year. As simple as that.

The strategy was initially published by Michael B. O'Higgins in 1991 and further popularized by Jemery Siegel in his book The Future for Investors in 2005. According to the latter, the Dogs of the Dow strategy outperformed the market up until 2003:

| Strategy 1957-2003 | Annual return | Result of $1,000 invested in 1957 |

|---|---|---|

| Dogs of The Dow Strategy | 14.3% | $493,216 |

| S&P 500 index | 11.2% | $130,768 |

The performance looks impressive, although annual expenses for portfolio rebalancing, reinvesting dividends, and paying dividend tax are not reflected in these numbers.

Unfortunately, the Dogs of the Dow haven't been able to keep up with this performance since then. Below are the results of investing in the Dogs of the Dow from 2000-2022:

| Strategy 2000-2022 | Annual return | Result of $1,000 invested in 2000 |

|---|---|---|

| Dogs of The Dow Strategy | 7.8% | $3,190 |

| S&P 500 index | 8.0% | $4,040 |

Again, these numbers do not include the expenses of reinvesting the dividends or rebalancing the portfolio and paying taxes annually. This all makes the strategy look less attractive.

What are the advantages of dividend stocks?

We have seen that dividend investing comes with extra expenses and that we can't expect it to beat the market in terms of total returns. But are there really no advantages to dividend stocks, you might think?

Softer drawdowns

The real advantage of dividend investing is the fact that it most often comes with lower volatility as well as softer drawdowns compared to the overall market. During the great financial crisis, the S&P 500 index suffered a drawdown of 50.9%, while the Dividend Aristocrats lost only 44.1%.

A similar trend can be found in most market corrections and using most dividend strategies. Looking at the return chart for the Dividend Aristocrats above, it's also obvious that dividend stocks tend to have a stronger performance during bear markets, while they tend to lag the market during bull markets.

A stable income

A lot of investors also like the stable income coming from dividends. This, however, only make sense if you need the money and you're not planning to reinvest them. Typically this is the case when you are no longer adding to your investments, but rather living off them.

Who should invest in dividend stocks?

For people who don't like the rollercoaster ride and the drawdowns involved with typical stocks or market indices, dividend stock can provide a slightly more stable experience. If you are ready to accept returns that may be a bit lower than the market to achieve this, dividend investing is definitely a viable option.

For pensioners or other investors who no longer add to their investments, and who like to have a steady flow of cash withdrawn from their portfolio, dividend stocks can serve a purpose as well.

Should you avoid dividend stocks?

Personally, I don't avoid dividend stocks. A lot of other qualities are much more important for my decision to buy into a stock. If the stock looks attractive on other parameters, I would still buy it, but if the choice was mine, there would never be any dividend paid out from my stocks.

Conclusions

It seems to be a common understanding that dividend investing is a good and reasonable strategy, and back in the twentieth century, it seems to have provided returns above market level. But as evidence now shows:

Dividend investing strategies are no longer able to consistently beat the market - not even with dividends reinvested. They come with drawbacks in terms of expenses for reinvesting and paying taxes up front on dividends on an ongoing basis.

Dividend stocks can however provide a stable income for people who need this, as well as lower volatility and softer drawdowns during bear markets.