The Secret Truth About Financial Analysts and Their Stock Market Predictions

Highly paid expert analysts are the kings of the stock market - or at least so it may seem when they issue buy and sell ratings and update their predicted price targets on the stocks we follow. Among the most common news in financial media are the headlines stating that "Morgan Stanley raised their price target on Amazon to $145" or similar. This suggests that we can now with peace in mind buy Amazon stocks and expect them to rise. Because the highly esteemed expert analysts said so. Right?

Active fund managers are underperforming

It is gradually becoming a well-known fact that actively managed stock funds are underperforming their passive counterparts, also known as index funds. This may seem counterintuitive, as the whole point in actively managed funds is to pay professional analysts to carefully pick stocks that will provide better returns than simply buying the market average through a low-cost index fund or an ETF.

The ARK example

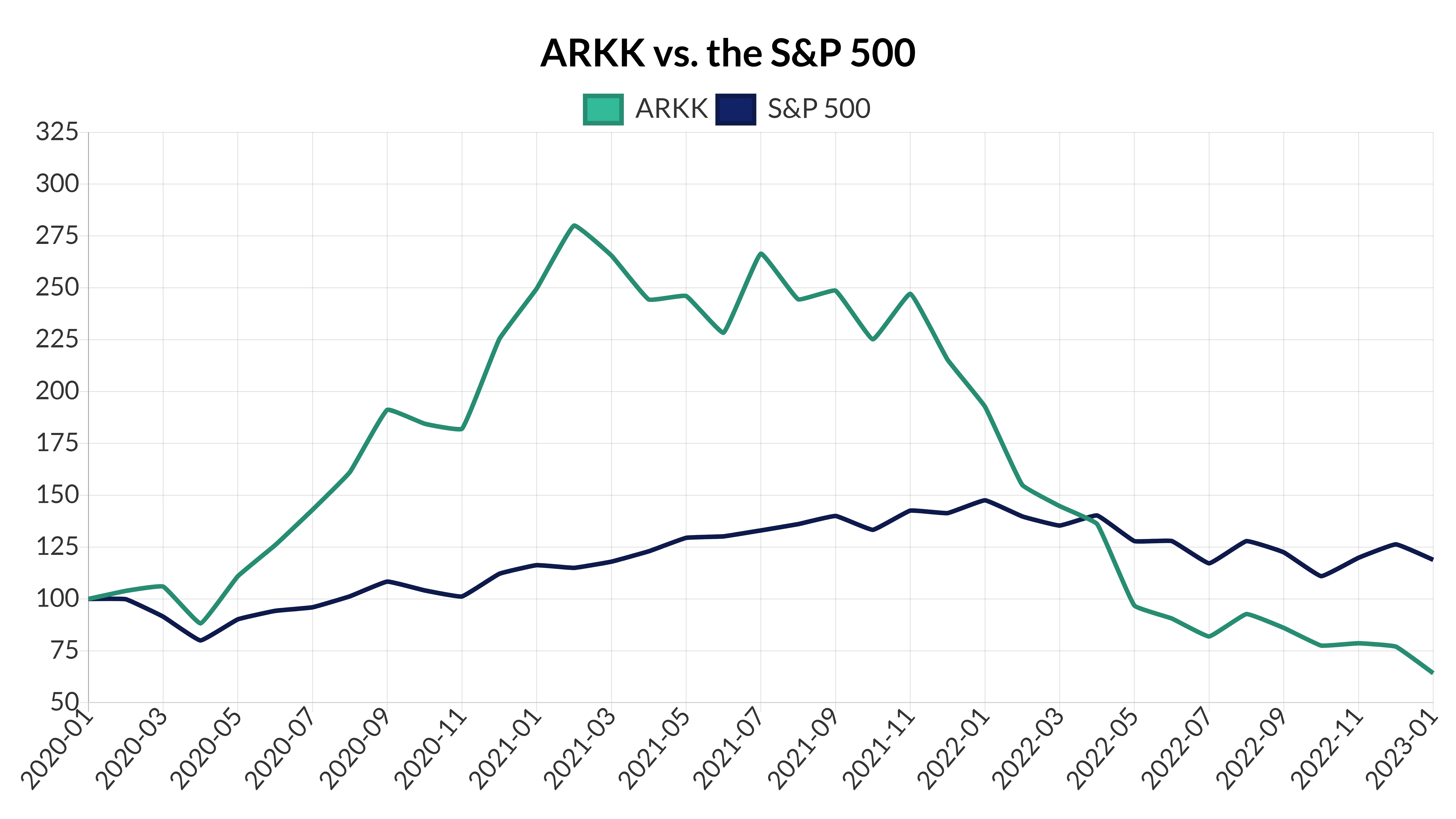

Every year there are funds that outperform the market significantly and attract billions of investment dollars from new customers afterwards. A famous example is the ARK Innovation ETF managed by Cathie Wood, which returned an astonishing 152% in 2020.

Cathie Wood was heralded as a genius and everyone wanted to have a piece of the cake. But in the following two years, the fund lost 23% (in 2021) and 67%, thus erasing the entire gain from 2020 and continuing even lower. Over the three years from 2020 to 2022 the fund ended up underperforming the S&P 500 by more than 20% despite the phenomenal initial success.

Over shorter periods there will always be market circumstances, luck, or randomness that make certain funds shine and outperform the market. But the problem is that it's nearly impossible to maintain a sustained outperformance, it seems. The longer the time horizon we look at, the fewer funds are able to keep up with the market returns.

A study published in New York Times in 2022 revealed that out of 2,132 actively managed funds, not a single one of them was able to consistently beat the market over a five year period. The passively managed index funds would always win in the long run.

Then what about someone like Warren Buffett, you might ask. It turns out not even Warren Buffett is able to beat the market anymore.

What do analysts know?

You might wonder if the analysts that are hired to manage mutual funds and ETFs are not always from the highest level. Maybe there are hedge fund managers or investment bankers that attract the brightest stock analysts?

A few years back, I had the pleasure of getting to know some of these financial analysts at the highest level through work experience. They had an extremely deep knowledge of the companies they covered, and they would have weekly or sometimes daily phone calls with senior-level employees at the companies to always be up-to-date on every little detail. They would know all the key financial numbers and metrics by heart and they would put them through their complex algorithms and forecasting formulas. These guys were working day and night to gain that edge over competitors in knowing as much as possible.

With all this information at hand, their primary job was to issue buy and sell recommendations as well as update target prices on each of the stocks. And how did that work out? Well, maybe you guessed it.

The secret of the financial industry

If you look at any investment bank website, you will notice they only look forward. All the focus is on their future ratings and target prices. Why is there no looking back and evaluating on historical predictions to measure how they were doing? The answer is simple: Because they don't want you to know.

In 2018 the European Union introduced new compliance regulations called MiFiD II which required all financial services and investment banks to make their historical recommendations and target price changes publicly available. Still today this information is hard to find because it's hidden away in compliance documents written with small letters, that nobody cares to read.

Hiding the facts

Many of the people working in this sector are driving sports cars and live in fancy coastal mansions. But the secret is, that they are rarely any better at predicting stock prices than anybody else. The deep knowledge they have of the companies simply doesn't compute into useful stock price predictions. If that were the case, they would proudly present their historical performance. Notice how rare it is to see anyone publish their historical returns. There are reasons for this: It simply puts them in a better light to hide these cold facts away and not talk about them.

Beaten by monkeys

In his bestselling book A Random Walk Down Wall Street from 1973, Burton Malkiel famously stated that "a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts". This controversial statement was frowned upon by the industry, but numerous studies have since then put the hypothesis to the test, and the conclusions leave no doubt that Malkiel was right.

The wonders of randomness

Numerous other studies have experimented with everything from rats and cats to goldfish picking stocks randomly. The common conclusion is that these randomly generated stock portfolios not only beat the selections made by analysts, but also the main market indices like the S&P 500. How is that even possible?

The first time people hear about the fact that monkeys did better than analysts at selecting stock, they tend to think it was a lucky punch, or that there is some logical explanation as to why it happened in that certain case. But the matter of fact is - there are logical explanations as to why the monkeys (or the randomness) actually beat the analysts. Let's dig deeper into this:

Analysts suffer from human biases like everyone else

Analysts are humans like the rest of us. They suffer from all the same psychological biases as we do when they don't follow a pure algorithm-based trading system. You can read more about this in my post about investment biases.

They purely focus on fundamental analysis

Traditionally, most financial analysts purely focus on fundamental analysis, meaning they analyze all the financial metrics, the outlooks of the sector, and the macro economy. This focus tends to be good at finding undervalued stocks, but undervalued stocks will only outperform the market in periods where the value stock paradigm is in the lead - which is not the case most of the time.

But looking a bit deeper into the matter, there is also a more technical explanation for this phenomenon.

Understanding the large-cap trap

Most wide market indices like the S&P 500 are market capitalization weighted. This means the higher the market value of a company, the larger its weight in the index. Thus, large companies account for most of the movement in an index like the S&P 500.

It's a proven fact, however, that smaller stocks have provided larger historical average returns than their large-cap counterparts. This has to do with the fact that investors take on more risk by investing in a small company. To account for the extra risk, the investor must be rewarded with a slightly higher expected return. Just like stocks on average provide higher returns than bonds, because bonds tend to be less volatile and thus less risky.

Small stocks for a different weighting

Financial analysts and particularly fund managers typically focus mostly on large stocks, as these are the ones we hear about in the media and the ones most people care about. But picking large stocks only will not make it any easier to beat the S&P 500 index. And with all the human emotions and other bad forces that affect human analysts, it's really hard to consistently beat the index in the long term.

When picking stocks randomly, like the monkeys did, there is no preference for large stocks over small stocks. By selecting 20 random stocks from the S&P 500, you will almost always end up with a portfolio with a significantly lower average size or market value of the individual stocks. The volatility or risk might be higher than by buying the S&P 500 index, but in the long run, the average returns will typically be higher.

Conclusions

So, to sum up: Even the brightest professional analysts and experts with all the information and numbers at hand are typically not able to predict the direction of a stock or to use this information to outperform the market. The analysts are affected by various forces and biases that make it hard for them to even catch up with the an index performance. Monkeys and other means of randomness are able to beat the analysts because they are not affected by psychology and they will randomly select smaller stocks that typically provide higher returns.

The final question might be: Why don't fund managers just copy the monkey approach and pick stocks randomly and with a smaller average size? I believe this comes down to two main reasons. First of all, customers expect to see big well-known company names in their portfolios. Names they know about from the media. But maybe more importantly, picking stocks randomly can be done by a machine. The analysts and fund managers would lose their jobs.